A bullish reversal pattern that forms when the price tests a support level three times…

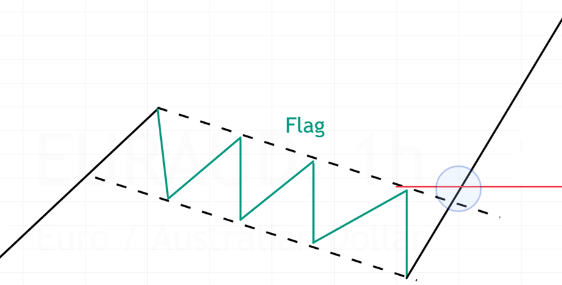

Bullish Flag

A Bullish Flag is a short-term continuation pattern that appears after a strong price rally. It forms a small downward or sideways consolidation resembling a flag on a pole. Once the price breaks out above the flag, it signals a continuation of the uptrend. This pattern indicates a brief pause before the next upward move.

Significance

- Indicates that buyers are taking a pause before resuming the uptrend.

- Suggests a healthy correction rather than a reversal.

- A breakout above the flag confirms the continuation.

Characteristics

- Strong price movement leading into the flag formation.

- Breakout occurs when price moves above flag resistance.

- Volume declines during formation and spikes on breakout.

Market Condition

- Forms during an uptrend, acting as a consolidation phase.

- More effective when accompanied by strong momentum indicators.

Trading Strategy

- Entry point – Buy when price breaks above the flag with strong volume.

- Stop-loss – Below the flag’s lower trendline.

- Target price – Measure the flagpole height and add it to the breakout level.