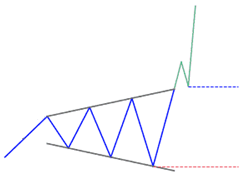

A widening price formation characterized by lower lows and higher highs, forming a megaphone-like shape. This pattern signifies extreme volatility and growing instability, often occurring after a prolonged downtrend where price swings widen before reversing direction.

✳️ Pattern Formation

- Appears after a sustained downtrend, as selling pressure begins to fade

- Structure forms through expanding price swings, creating a broadening shape

- Indicates accumulation as buyers start entering at higher lows

🔷 Characteristics

- Consists of progressively lower lows and higher highs, forming a megaphone shape

- Support and resistance trendlines diverge, showing increased volatility

- Breakout occurs above the resistance line, indicating bullish momentum

- Volume typically increases sharply on breakout, confirming reversal

🌐 Market Condition

- Effective in high-volatility markets such as equities, indices, and forex pairs

- Best suited for liquid instruments during late-stage downtrends or accumulation

🎯 Trading Strategy

- Enter a long position after breakout above resistance with strong volume.

- Set the stop-loss just below the most recent swing low for protection.

- Calculate the target by adding pattern width to the breakout level.