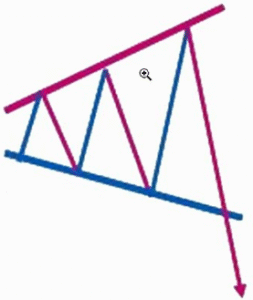

A widening price pattern where price forms higher highs and lower lows, signalling increasing volatility. This pattern suggests market instability and potential trend exhaustion, as bullish momentum weakens despite frequent rallies.

✳️ Pattern Formation

- Forms after a prolonged uptrend, where buyers begin to lose control

- Structure emerges through increasing price swings, signaling exhaustion

- Often seen in distribution phases with unpredictable momentum shifts

🔷 Characteristics

- Composed of expanding highs and lows, forming a broadening triangle

- Resistance and support lines diverge, creating an unstable price range

- Breakout occurs below the lower boundary, confirming bearish intent

- Volume typically spikes on breakdown, validating the reversal

🌐 Market Condition

- Works best in volatile uptrending markets nearing exhaustion

- Suitable for liquid stocks, commodities, and major indices experiencing topping patterns

🎯 Trading Strategy

- Sell when price breaks support with strong volume to confirm the move.

- Set stop-loss slightly above the recent swing high to manage risk.

- Calculate the target by subtracting the pattern width from breakdown level.

Rate this post