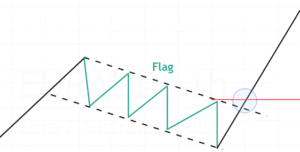

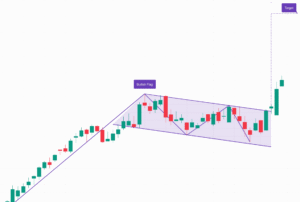

A Bullish Flag is a short-term continuation pattern that appears after a strong price rally. It forms a small downward or sideways consolidation resembling a flag on a pole. Once the price breaks out above the flag, it signals a continuation of the uptrend. This pattern indicates a brief pause before the next upward move.

💡 Significance

- Indicates that buyers are taking a pause before resuming the uptrend.

- Suggests a healthy correction rather than a reversal.

- A breakout above the flag confirms the continuation.

✳️ Pattern Formation

- Forms after a strong upward rally, showing temporary price consolidation

- Pattern completes when price breaks above the flag’s upper boundary

- Commonly observed in momentum-driven and trending markets

🔷 Characteristics

- Price forms a flagpole followed by a small downward or sideways flag

- Trendlines of the flag are parallel or slightly downward-sloping

- Breakout above the flag confirms bullish continuation

- Volume declines during consolidation and spikes on breakout

🌐 Market Condition

- Best suited for bullish trending markets in stocks, indices, or commodities

- Most effective in high-liquidity instruments with strong upward momentum

🎯 Trading Approach

- Buy when price breaks above the flag with strong volume confirmation.

- Set stop-loss just below the lower trendline of the flag consolidation.

- Estimate the target by adding flagpole height to the breakout level.