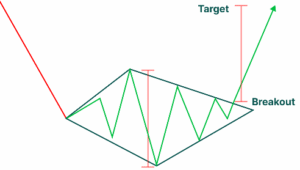

A bullish reversal pattern formed by a diamond-shaped price structure, starting with wide swings and ending with narrowing consolidation; a breakout above the upper boundary signals a strong shift to bullish momentum.

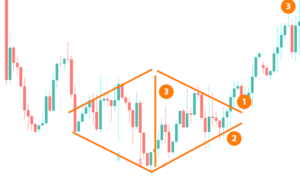

✳️ Pattern Formation

- Forms at the end of a downtrend, where price initially expands and then contracts

- Completion occurs when price breaks out above the upper boundary of the diamond

- Typically seen in volatile markets where reversal is building strength

🔷 Characteristics

- Starts with widening price swings, forming the left half of the diamond

- Followed by narrowing consolidation, forming the right half

- The structure resembles a rhombus or diamond shape on the chart

- Breakout above resistance line confirms a bullish trend shift

🌐 Market Condition

- Best suited for stocks, indices, and commodities experiencing high volatility

- Works well in liquid instruments during bottoming phases

🎯 Trading Strategy

- Enter a long trade once price breaks above the upper diamond boundary.

- Set stop-loss just below the lowest point of recent consolidation.

- Target is calculated by adding diamond height to the breakout price level.