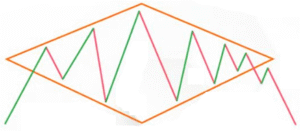

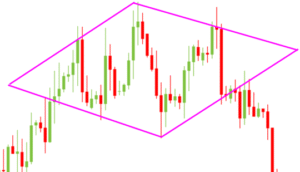

A diamond-shaped formation that occurs after an uptrend, indicating a bearish reversal. This pattern emerges due to increasing price volatility, where the market first expands before consolidating, forming a structure resembling a diamond.

✦ Formation Context

- Forms at the end of an uptrend, where price becomes increasingly volatile.

- Reflects buyer exhaustion, as the trend loses upward strength.

- Indicates early distribution by large players in volatile conditions.

- Commonly appears in high-volume stocks or major indices near tops.

- Reliability increases with a confirmed breakdown and rising volume.

🛠️ Key Visual Features

- Begins with widening price swings forming the left half of the diamond.

- Narrowing consolidation completes the right side of the formation.

- Breakdown happens when price falls below the lower boundary line.

- Volume spikes on breakdown, confirming strong bearish sentiment.

- The full structure forms a symmetrical diamond or broadening top.

🎯 Trading Approach

- Sell when price breaks below support with strong volume confirmation.

- Place stop-loss above the recent consolidation high for protection.

- Target is calculated by subtracting diamond height from breakdown level.

Rate this post