The Directional Movement Index (DMI) is a trend strength indicator developed by J. Welles Wilder Jr. It helps traders determine whether a market is trending and how strong that trend is. The DMI consists of three components: +DI (positive directional indicator), -DI (negative directional indicator), and the ADX (Average Directional Index). While +DI and -DI show the direction of the trend, the ADX measures its strength. Together, they help traders make better decisions on trend-following entries and exits.

💡 Significance

- Identifies trend direction using +DI and -DI crossovers.

- Measures trend strength through the ADX line.

- Distinguishes trending from sideways markets to avoid false signals.

- Supports entry timing when trend direction and strength align.

- Works well with other indicators like Moving Averages and RSI.

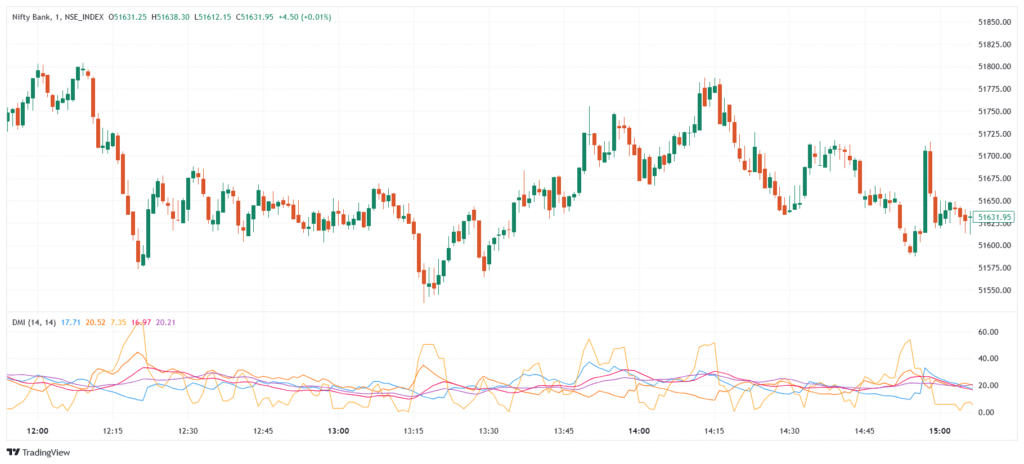

📊 Indicator Components & Values

- +DI (Positive Directional Indicator) → Measures strength of upward movement.

- -DI (Negative Directional Indicator) → Measures strength of downward movement.

- ADX (Average Directional Index) → Indicates trend strength (rising ADX = strong trend).

- Crossover Signals →

- +DI crosses above -DI → Possible buy signal.

- -DI crosses above +DI → Possible sell signal.

- ADX Levels →

- Above 25 → Strong trend.

- Below 20 → Weak or no trend.

🎯 Trading Strategy

- Trend Following →

- Buy when +DI crosses above -DI and ADX is rising above 25.

- Sell when -DI crosses above +DI and ADX is rising above 25.

- Filter Sideways Markets → Avoid trades when ADX is below 20.

- DMI + Moving Average → Confirm trend direction with price above/below MA.

- DMI + RSI → Use RSI to confirm momentum during trend signals.

- Early Exit or Reversal → Consider exiting when ADX starts falling or +DI/-DI lines cross back.