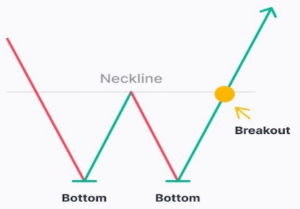

A W-shaped formation where price tests a support level twice at nearly the same level but fails to break lower. This pattern signals a potential trend reversal from a downtrend to an uptrend. It forms after a prolonged bearish trend, and a breakout above the middle peak resistance confirms the bullish reversal.

💡 Significance

- Suggests strong support at a key level, preventing further price decline.

- Indicates buyers are stepping in, absorbing selling pressure and preparing for an uptrend.

- A breakout above the middle peak confirms the trend reversal, signalling buying momentum.

✳️ Pattern Formation

- Forms after a sustained downtrend, as selling momentum weakens

- Structure completes when price tests support twice and breaks neckline resistance

- Commonly develops during accumulation phases or oversold zones

🔷 Characteristics

- Two distinct lows near the same price level form the double bottom

- A peak between troughs acts as resistance (neckline)

- Volume often increases during the second bottom and breakout

- The pattern confirms only when price breaks above the neckline

🌐 Market Condition

- Suitable for equity markets, indices, and forex pairs in oversold phases

- Best used in liquid instruments showing signs of trend exhaustion

🎯 Trading Strategy

- Entry Point: Buy when price breaks above the neckline with strong volume

- Stop-loss: Below the second bottom low to manage risk

- Target Price: Measure the distance from neckline to bottom and project it upward