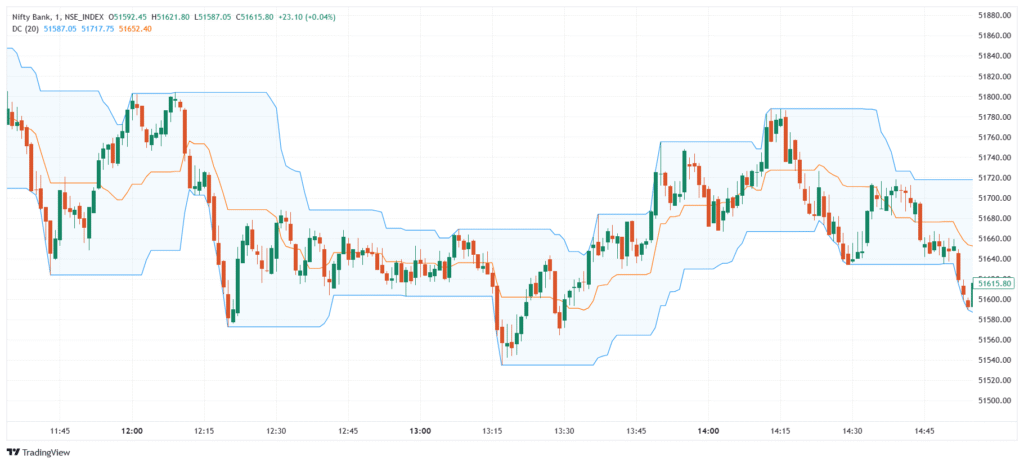

Donchian Channels are a trend-following indicator developed by Richard Donchian, often called the “father of trend following.” The indicator plots three lines: an upper band, a lower band, and a middle line. The upper band shows the highest high, and the lower band shows the lowest low over a selected period (commonly 20 periods). The middle line is the average of the two. Donchian Channels help traders identify breakouts, trend direction, and support/resistance zones.

Significance

- Highlights price breakouts by showing the high-low range over time.

- Helps define trend direction using price position relative to the bands.

- Marks support and resistance levels clearly on the chart.

- Detects volatility expansion through channel widening.

- Used for breakout and trend-trading strategies.

Indicator Components & Values

- Upper Band → Highest price over the chosen period (e.g., 20 days).

- Lower Band → Lowest price over the same period.

- Middle Line → Average of upper and lower bands (optional).

- Channel Width → Expands with volatility and contracts during consolidation.

- Price Relative to Bands →

- Above upper band → Bullish breakout.

- Below lower band → Bearish breakout.

Trading Strategy

- Breakout Strategy →

- Buy when price breaks above the upper band.

- Sell when price breaks below the lower band.

- Trend-Following Strategy → Stay in trade as long as price stays near the outer band.

- Pullback Entry → Enter when price pulls back near the middle line in a strong trend.

- Donchian + Volume → Confirm breakouts with rising volume.

- Donchian + RSI/MACD → Use with momentum indicators to filter false signals and confirm direction.

5/5 - (1 vote)