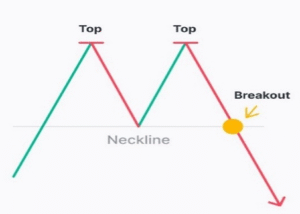

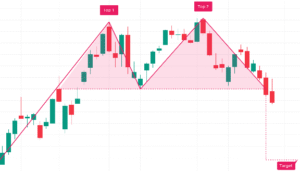

A M-shaped pattern where price tests resistance twice at nearly the same level but fails to break higher. This pattern signals that buyers are losing strength, and a breakdown below support confirms a bearish trend reversal.

💡 Significance

- Suggests that strong resistance is preventing further price increases.

- Indicates a shift in market sentiment from bullish to bearish.

- A breakout below support confirms the reversal and signals selling pressure.

✳️ Formation Context

- Develops during an uptrend, when price tests the same resistance level twice

- Pattern completes when price breaks below the intermediate trough (neckline)

- Commonly appears during the distribution phase, indicating declining buyer interest

🔷 Characteristics

- Two peaks form near the same price level, showing strong resistance

- Trough between the peaks acts as a neckline and potential support

- Breakdown below neckline confirms the bearish reversal

- Volume often decreases on the second peak and rises on breakdown

🌐 Market Condition

- Most effective in equity and index markets during overbought or extended bullish phases

- Best suited for liquid instruments showing signs of trend fatigue

🎯 Trading Strategy

- Enter short once price closes below the support with volume confirmation.

- Set stop-loss just above the second peak to limit potential loss.

- Target is calculated by subtracting pattern height from breakdown level.

Rate this post