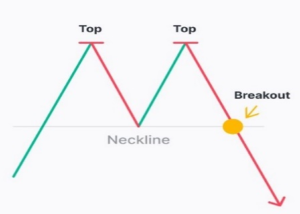

A M-shaped pattern where price tests resistance twice at nearly the same level but fails to break higher. This pattern signals that buyers are losing strength, and a breakdown below support confirms a bearish trend reversal.

Significance

- Suggests that strong resistance is preventing further price increases.

- Indicates a shift in market sentiment from bullish to bearish.

- A breakout below support confirms the reversal and signals selling pressure.

Characteristics

- Two equal highs testing a key resistance level.

- Breakout occurs when price drops below the middle support between peaks.

- Volume declines at the second peak and rises on the breakdown.

Market Condition

- Forms after a prolonged uptrend, signalling that the trend is weakening.

- More effective when accompanied by decreasing momentum indicators.

Trading Strategy

- Entry point – Short when price breaks below the support

- Stop-loss – Above the second peak to limit losses.

- Target price – Measure the pattern height and subtract it from the breakdown level.