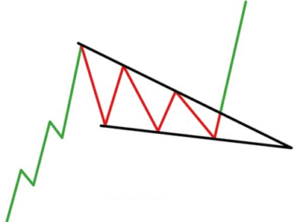

A bullish reversal pattern that forms when the price moves lower within a narrowing downward-sloping channel. This pattern indicates that selling pressure is weakening, and a breakout to the upside is likely. It signals that buyers are gradually taking control, leading to a potential trend reversal from a downtrend to an uptrend.

💡Significance

- Suggests that sellers are losing strength, as price fails to make significantly lower lows.

- Indicates buyer accumulation, as price moves within a narrowing range.

- A breakout above the wedge confirms the trend reversal, signalling a shift to bullish momentum.

✳️ Formation Context

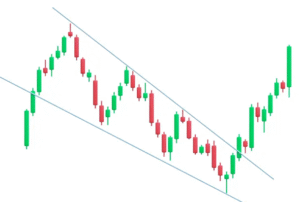

- Forms during a prolonged downtrend, where price declines slow down with tighter ranges

- Develops as price compresses downward within narrowing trendlines

- Indicates buyer accumulation while sellers gradually lose control

🔷 Characteristics

- Lower highs and lower lows form two converging downward trendlines

- Volume typically contracts throughout the wedge and rises at breakout

- Breakout above the upper trendline confirms a bullish reversal

- Pattern often completes near the apex of the wedge

🌐 Market Condition

- Suited for declining or oversold markets showing early signs of reversal

- Effective in stocks, indices, and forex during bottoming phases

🎯 Trading Strategy

- Entry Point: Buy when price breaks above the upper trendline with strong volume

- Stop-loss: Set below the last swing low inside the wedg

- Target Price: Measure the widest height of the wedge and add to breakout level