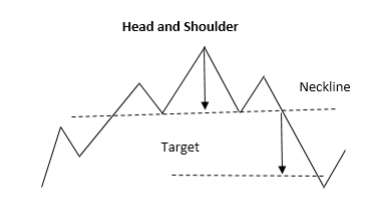

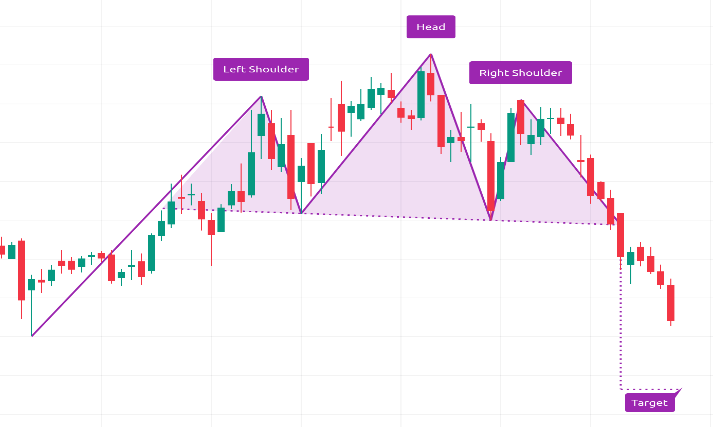

A three-peak formation where the middle peak (head) is the highest, while the side peaks (shoulders) are lower. This pattern signals a potential trend reversal from an uptrend to a downtrend. It forms after a strong bullish trend, and a breakout below the neckline support confirms the shift to bearish momentum.

✳️ Formation Context

- Forms after a sustained uptrend, as buying strength starts to weaken gradually

- Structure completes when the right shoulder forms and price breaks the neckline

- Commonly appears during market distribution phases before a reversal begins

🔷 Characteristics

- Left Shoulder forms a peak followed by a minor decline

- Head is the highest point, exceeding both shoulders

- Right Shoulder is a lower peak, mirroring the left shoulder

- Neckline connects the lows between shoulders and acts as key support

- Volume decreases progressively from left shoulder to right shoulder

🌐 Market Condition

- Most effective in equity markets, major indices, and commodities

- Works best in liquid instruments and during trend reversal zones

🎯 Trading Strategy

- Entry Point: Sell when price breaks below the neckline with increased volume

- Stop-loss: Above the right shoulder high to limit upside risk

- Target Price: Subtract the height from head to neckline from the breakdown point

Rate this post