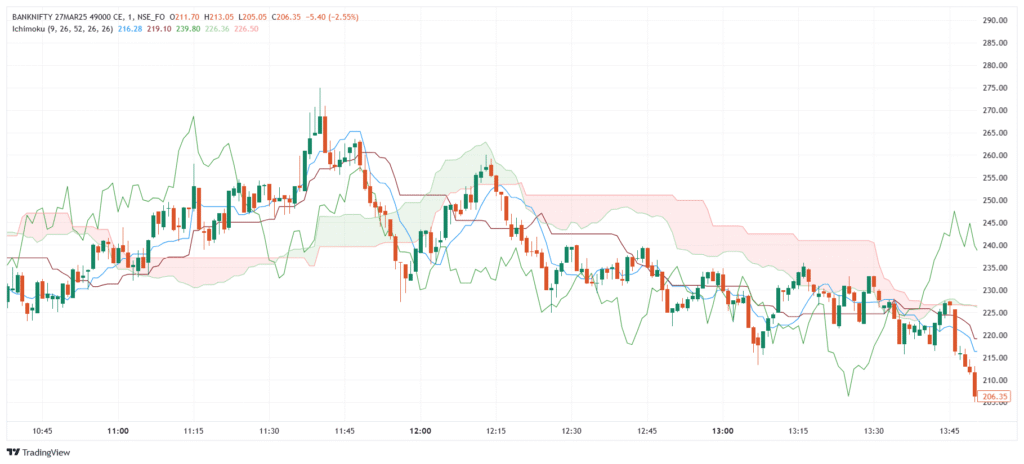

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a complete trend-following indicator developed by Goichi Hosoda, a Japanese journalist, in the 1930s. It gives a broad view of price action, including trend direction, support/resistance, momentum, and entry/exit signals—all in one chart. The “cloud” (Kumo) is the shaded area between two lines and shows future support/resistance zones and market strength.

💡 Significance

- Shows trend direction through price position relative to the cloud.

- Identifies support/resistance using the cloud and key lines.

- Gives early signals through crossovers and cloud twists.

- Displays momentum/consolidation in one visual setup.

- Useful across timeframes, from scalping to swing trading.

📊 Indicator Components & Values

- Tenkan-sen (Conversion Line) = (9-period high + 9-period low) ÷ 2

- Short-term trend guide.

- Kijun-sen (Base Line) = (26-period high + 26-period low) ÷ 2

- Mid-term trend/resistance level.

- Senkou Span A = (Tenkan-sen + Kijun-sen) ÷ 2

- First cloud edge, projected 26 periods ahead.

- Senkou Span B = (52-period high + 52-period low) ÷ 2

- Second edge, also projected forward.

- Chikou Span (Lagging Line) = Current close plotted 26 periods back

- Confirms trend and support.

- Kumo (Cloud) = Area between Span A and B

- Thick cloud = Strong trend; Thin cloud = Weak zone

- Price above cloud = Bullish, below = Bearish, inside = Neutral

🎯 Trading Strategy

- Trend Strategy → Buy when price is above cloud, and Tenkan crosses Kijun. Sell when price is below cloud with bearish crossover.

- Breakout Strategy → Enter when price breaks cloud with confirmation and rising Chikou Span.

- Kumo Twist Signal → Span A crossing Span B hints early trend change.

- Chikou Confirmation → Lagging line must support the trend (above/below price).

- Stop-loss & Target → Use cloud edges or Kijun-sen for stop; recent highs/lows for targets.