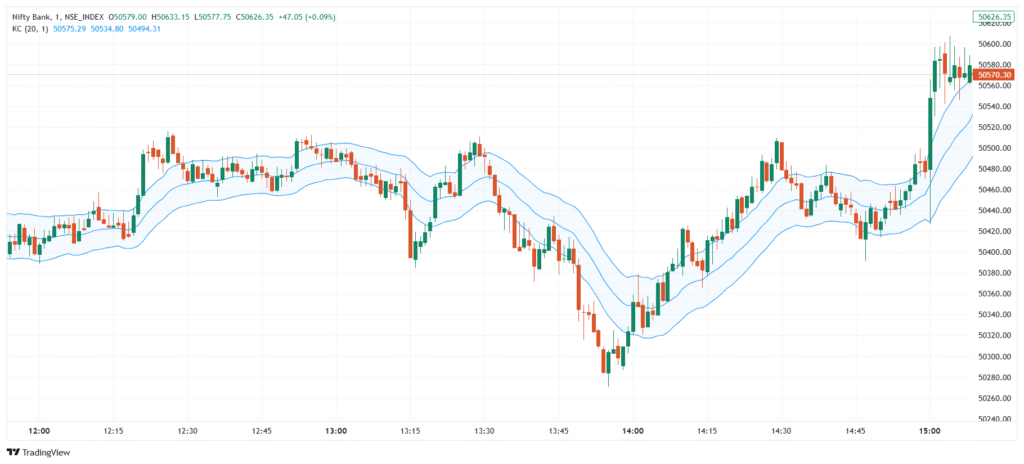

Keltner Channels are a volatility-based indicator developed by Chester Keltner and later refined by Linda Raschke. They consist of a central line (usually a 20-period EMA) and upper/lower bands set at a multiple (commonly 2×) of the Average True Range (ATR). Unlike Bollinger Bands, which use standard deviation, Keltner Channels use ATR to define band width and help identify trend direction, breakouts, and price extremes.

💡 Significance

- Measures volatility using ATR to set channel width.

- Identifies trend direction when price consistently stays near one band.

- Signals potential breakouts when price moves outside the channel.

- Helps detect overbought and oversold levels within a trend.

- Works well with trend and momentum indicators like RSI, MACD, and Moving Averages.

📊 Indicator Components & Values

- Middle Line → 20-period Exponential Moving Average (EMA).

- Upper Band → EMA + (Multiplier × ATR), shows resistance or overbought level.

- Lower Band → EMA − (Multiplier × ATR), shows support or oversold level.

- ATR Multiplier → Commonly set to 2× ATR, adjustable for sensitivity.

- Channel Width → Expands or contracts based on market volatility.

🎯 Trading Strategy

- Trend Continuation Strategy → Buy when price holds near or above the upper band; sell when near or below the lower band.

- Breakout Strategy → Enter trades when price closes outside the channel, expecting trend continuation.

- Reversal Strategy → Look for reversal signals when price touches the outer band and fails to break through.

- Keltner + RSI → Confirm overbought/oversold signals using RSI when price touches the bands.

- Keltner + Moving Average → Use a longer-term MA (e.g., 50 or 200 EMA) to confirm the overall trend direction.

Rate this post