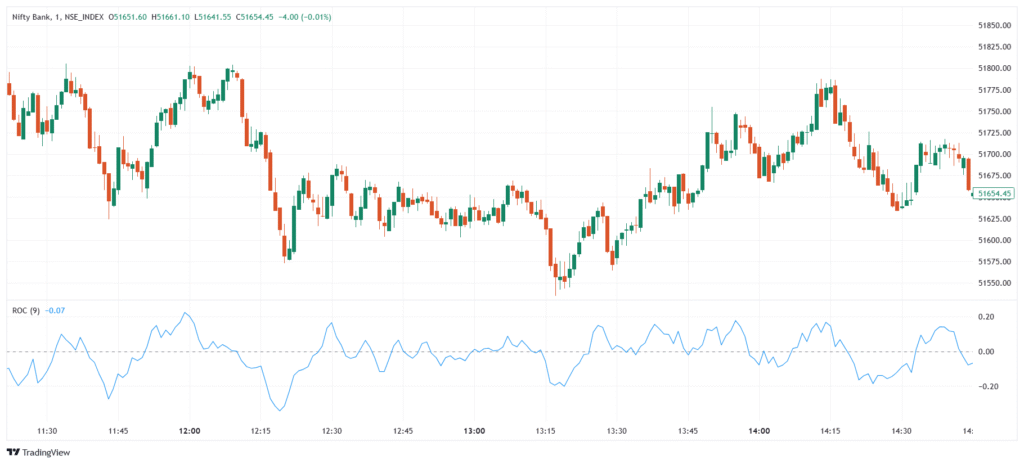

The Rate of Change (ROC) is a momentum oscillator that measures the percentage change in price between the current price and the price a set number of periods ago. It helps traders understand how fast price is moving and in which direction. ROC values fluctuate above and below a zero line: positive values indicate upward momentum, and negative values suggest downward momentum. It is often used to identify trend strength, reversals, and overbought/oversold conditions.

Significance

- Measures price momentum based on percentage change over time.

- Identifies trend direction — positive for uptrend, negative for downtrend.

- Detects overbought and oversold conditions when ROC reaches extreme highs or lows.

- Confirms breakouts and trend strength when ROC moves strongly away from zero.

- Useful in all market types, especially for swing and momentum trading.

Indicator Components & Values

- ROC Line → Oscillates above and below zero, showing the strength and direction of momentum.

- Zero Line →

- Above zero → Positive momentum (bullish).

- Below zero → Negative momentum (bearish).

- Lookback Period → Commonly set to 12 or 14 periods, but adjustable for sensitivity.

- Overbought/Oversold Zones → No fixed levels, but traders watch for extreme spikes to signal potential reversals.

Trading Strategy

- Zero Line Crossover → Buy when ROC crosses above zero, sell when it crosses below zero.

- Divergence Strategy → Buy when price makes a lower low and ROC makes a higher low (bullish divergence); sell on the opposite.

- Trend Confirmation → Use ROC to confirm the strength of a breakout or trend.

- ROC + Moving Average → Filter trades by checking ROC direction against a 50 or 200 MA.

- ROC + RSI → Combine with RSI to avoid false signals and confirm momentum shifts.

Rate this post