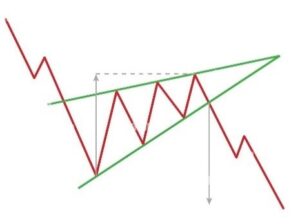

A narrowing upward pattern where price forms higher highs and higher lows, but the range contracts before breaking downward. This pattern signals that buyers are losing momentum, and a breakdown confirms a bearish trend.

💡 Significance

- Suggests that buying pressure is weakening, despite the uptrend.

- Often leads to a sharp price decline once support breaks.

- A breakout to the downside confirms the trend reversal.

✳️ Formation Context

- Forms after a sustained uptrend, where each rally becomes weaker and narrower

- Pattern develops as price compresses upward within converging lines

- Signals loss of control by buyers and potential distribution by smart money

🔷 Characteristics

- Higher highs and higher lows form two converging upward trendlines

- Volume typically declines as the wedge progresses, showing loss of momentum

- Breakdown below lower trendline signals start of bearish move

- May result in false breakouts, so confirmation is essential

🌐 Market Condition

- Works best in uptrending markets where momentum starts weakening

- Suited for indices, large-cap stocks, and commodities nearing exhaustion

🎯 Trading Strategy

- Entry Point: Sell when price breaks below the lower trendline with volume

- Stop-loss: Just above the last swing high within the wedge

- Target Price: Measure the height of the wedge base and subtract from breakdown

Rate this post