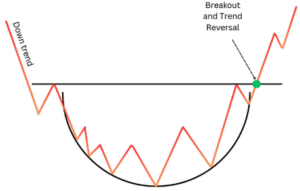

A U-shaped formation that indicates a gradual reversal from a downtrend to an uptrend. The pattern develops over an extended period, showcasing a slow shift in market sentiment from bearish to bullish. A breakout above the resistance level confirms the trend reversal.

✳️ Formation Context

- Forms after a sustained downtrend, as bearish momentum fades and accumulation begins

- Price forms a smooth, curved base showing transition from sellers to buyers

- Typically seen in weekly or daily charts during extended correction phases

🔷 Characteristics

- Price movement forms a broad U-shape, with no sharp lows or highs

- Volume is low during the base and increases as price nears breakout

- Breakout occurs when price crosses above resistance formed at the start of the decline

- Pattern develops slowly, often over weeks or months

🌐 Market Condition

- Best suited for long-term investments in stocks and indices recovering from deep corrections

- Effective in equity and commodity markets showing bottoming behavior

🎯 Trading Strategy

- Entry Point: Buy when price breaks above the resistance level with strong volume

- Stop-loss: Below the midpoint of the base or recent swing low

- Target Price: Measure the depth of the base and project it upward from the breakout