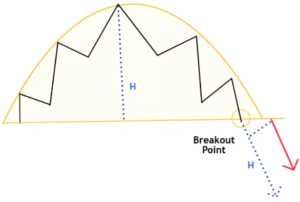

A gradual dome-shaped formation signalling a slow reversal from an uptrend to a downtrend. This pattern represents a distribution phase, where buyers gradually lose control, and selling pressure increases over time.

✳️ Formation Context

- Develops after a sustained uptrend, as bullish strength begins to fade gradually

- Price forms a rounded top structure, showing slow seller dominance over time

- Appears during distribution phases, before the trend reverses downward

🔷 Characteristics

- Price action forms a broad inverted U-shape, without sharp peaks or drops

- Volume is high near the start, then decreases, rising again near the breakdown

- Breakdown occurs when price falls below the support level formed at the base

- Takes several weeks or months to fully develop on higher timeframes

🌐 Market Condition

- Suited for long-term trend reversals in equities, commodities, and major indices

- Most effective in mature uptrending markets showing signs of exhaustion

🎯 Trading Strategy

- Entry Point: Sell when price breaks below the base support with increased volume

- Stop-loss: Above the right side swing high near the breakdown

Target Price: Measure the height of the top and subtract it from the breakdown level