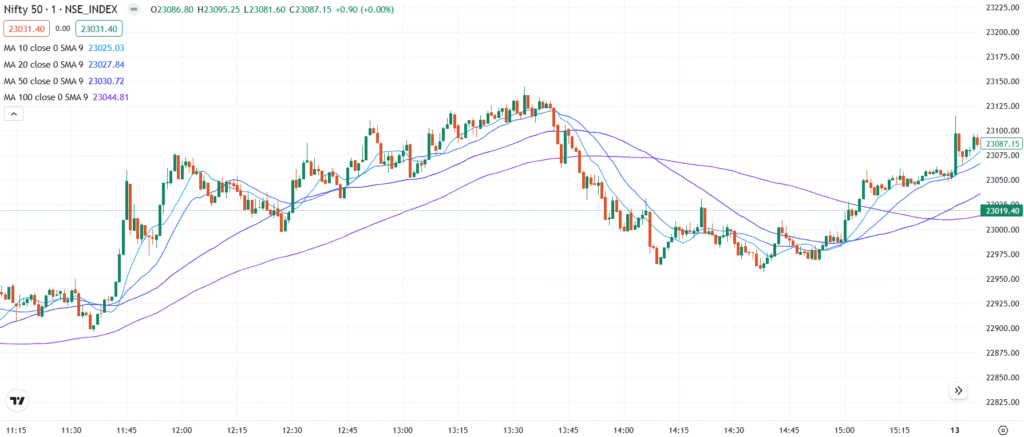

The Simple Moving Average (SMA) is a popular technical indicator that helps traders identify price trends. It calculates the average closing price of a stock or asset over a set number of days, smoothing out short-term price movements to make trends clearer.

💡 Significance

- Identifying trends – Shows if prices are moving up (bullish) or down (bearish).

- Support & resistance levels – Prices often bounce off the SMA.

- Generating trading signals – Helps traders decide when to buy or sell.

- Reducing price noise – Makes price movements easier to understand.

- Works best in trending markets (clear uptrend or downtrend).

- Not effective in sideways markets, as price fluctuates around the SMA.

📊 Indicator Value & Interpretation

- Short-term SMA (10, 20 periods) – Reacts quickly to price changes, used for short-term trading.

- Medium-term SMA (50 periods) – Provides balanced signals, useful for swing traders.

- Long-term SMA (100, 200 periods) – Shows major trends, used by long-term investors.

🎯 Trading Strategy

- Trend Confirmation:

- Price above SMA → Uptrend (bullish) → Buying opportunity.

- Price below SMA → Downtrend (bearish) → Selling opportunity.

- SMA Crossovers for Trading Signals:

- Golden Cross (Buy Signal): Short-term SMA crosses above a long-term SMA → Strong uptrend.

- Death Cross (Sell Signal): Short-term SMA crosses below a long-term SMA → Weakening trend.

- Support & Resistance Levels:

- Uptrend: SMA acts as support → Price may bounce up.

- Downtrend: SMA acts as resistance → Price may drop further.