The Stochastic Oscillator is a momentum indicator developed by George Lane that compares a security’s closing price to its price range over a specific period, usually 14 periods. It helps traders identify overbought and oversold conditions by showing where the price is relative to recent highs and lows. The indicator consists of two lines: %K (fast line) and %D (slow line), both ranging from 0 to 100. It is widely used to spot potential reversals, trend shifts, and entry/exit points.

Significance

- Identifies overbought and oversold zones to anticipate reversals.

- Measures momentum strength based on price position in its range.

- Generates entry signals when %K crosses %D.

- Useful in sideways and trending markets.

- Combines well with trend indicators like moving averages for confirmation.

Indicator Components & Values

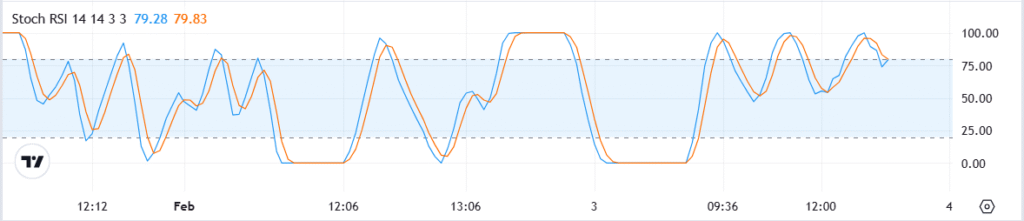

- %K Line (Fast Line) → Current close in relation to range over set period.

- %D Line (Signal Line) → 3-period moving average of %K.

- Overbought Level → Above 80 (possible sell signal).

- Oversold Level → Below 20 (possible buy signal).

- Crossovers →

- %K crosses above %D → Bullish signal.

- %K crosses below %D → Bearish signal.

Trading Strategy

- Overbought/Oversold Strategy → Buy when oscillator is below 20 and crosses up; sell when above 80 and crosses down.

- Crossover Strategy → Trade based on %K and %D crossovers in key zones.

- Trend Confirmation → Use Stochastic with a moving average to ensure signals align with the trend.

- Divergence Strategy → Buy when price makes lower lows but Stochastic makes higher lows (bullish divergence); sell on the opposite setup.

- Stochastic + RSI or MACD → Combine with other momentum indicators to filter out false signals.

Rate this post