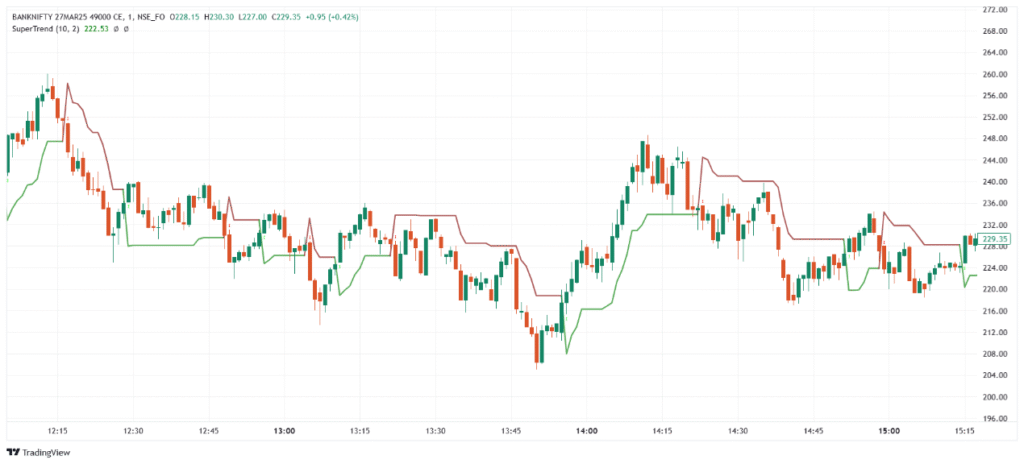

The Supertrend is a trend-following indicator that helps identify the direction of the market and gives clear buy or sell signals. It is plotted as a line above or below the price, changing position when the trend reverses. Supertrend uses the Average True Range (ATR) and a multiplier to determine its position and sensitivity. It works best in trending markets, offering easy visual cues for traders to follow the price direction.

💡 Significance

- Identifies market trend with clear color-coded signals.

- Simplifies trading decisions by showing whether to buy or sell.

- Adapts to volatility using ATR, adjusting to market conditions.

- Provides trailing stop-loss level for trade protection.

- Works well with other indicators like MACD or RSI for confirmation.

📊 Indicator Components & Values

- Supertrend Line → Plotted above or below price based on trend direction.

- ATR (Average True Range) → Measures volatility; affects Supertrend’s distance from price.

- Multiplier → Typically set to 3 or 1.5, adjusts the sensitivity of the indicator.

- Trend Signal →

- Line below price = Uptrend (Buy signal)

- Line above price = Downtrend (Sell signal)

- Color Change → Line shifts color or position when the trend reverses.

🎯 Trading Strategy

- Basic Strategy →

- Buy when Supertrend flips below price and turns green.

- Sell when Supertrend flips above price and turns red.

- Supertrend + Moving Average → Trade only when Supertrend and MA both confirm the same direction.

- Supertrend + RSI → Use RSI to avoid overbought/oversold traps and confirm trend strength.

- Trailing Stop Strategy → Use Supertrend line as a dynamic stop-loss to lock in profits.

- Breakout Confirmation → Enter trades after price breaks a key level and Supertrend aligns with direction.

Rate this post