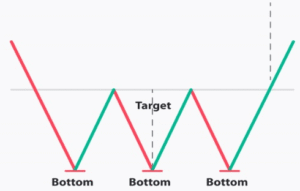

A bullish reversal pattern that forms when the price tests a support level three times but fails to break lower. This pattern signals strong buying pressure and a potential trend reversal from a downtrend to an uptrend. It is considered stronger than the Double Bottom since price has tested the support multiple times, showing that sellers have exhausted their control.

💡 Significance

- Suggests that sellers have tried and failed three times to push the price lower.

- Indicates buyer accumulation, making the support level stronger.

- A breakout above the resistance confirms a trend reversal, signalling a shift to bullish momentum.

✳️ Formation Context

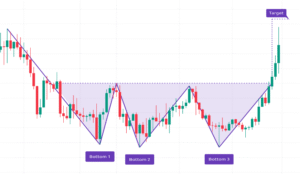

- Appears after a sustained downtrend, with price bouncing off support thrice

- Pattern completes when price breaks above the resistance formed between lows

- Signals the end of accumulation phase and transition to an uptrend

🔷 Characteristics

- Three distinct troughs form around the same support level

- Resistance line connects the highs between the lows

- Breakout above resistance confirms the bullish reversal

- Volume increases at breakout, supporting trend reversal strength

🌐 Market Condition

- Best suited for stock and commodity markets showing recovery signs

- Works well in liquid instruments during bottom formation or oversold zones

🎯 Trading Strategy

- Enter long when price breaks above the resistance with strong volume confirmation.

- Set stop-loss just below the third low to control downside risk.

- Target is derived by adding pattern height to the breakout level.