Factor Momentum (Trend Strength & Speed) Volatility (Price Fluctuations & Uncertainty) Definition Measures how fast…

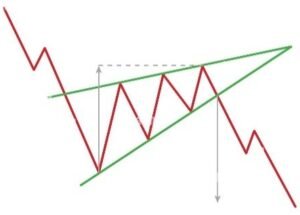

Rising Wedge

A narrowing upward pattern where price forms higher highs and higher lows, but the range contracts before breaking downward. This pattern signals that buyers are losing momentum, and a breakdown confirms a bearish trend.

Significance

- Suggests that buying pressure is weakening, despite the uptrend.

- Often leads to a sharp price decline once support breaks.

- A breakout to the downside confirms the trend reversal.

Characteristics

- Higher highs and higher lows, forming a contracting wedge.

- Breakout usually occurs downward when sellers take control.

- Volume declines during formation but rises significantly on breakdown.

Market Condition

- Found within an uptrend, signaling that the bullish momentum is slowing.

- More effective when supported by indicators like RSI divergence.

Trading Strategy

- Entry point – Short when price breaks below wedge support with volume.

- Stop-loss – Above the last swing high to reduce risk.

- Target price – Measure the wedge height and subtract it from the breakdown level.